The Enduring Value of PayPal: A Comprehensive Investment Case - Researched and Written using AI.

Navigating the Digital Tides: Why PayPal Remains a Compelling Investment

This is an educational post showing how powerful AI tools have become.

The only work I did was feed NotebookLM ten years of annual reports and proxy statements. Then, once NotebookLM had its sources, I asked several questions. From there, I gave Gemini the answers and prompted it to create this investment case.

I have not edited or changed anything of the AI-generated content. All I have done is copy, paste, and format. It has taken me more time to format this post for publishing than anything else.

I love writing and the creative process. This post kills me a bit.

However, it's exciting as an analyst having the ability to amass this much rich information in a matter of minutes.

It took me about 15 minutes to get this investment case created, and it was done all on mobile with a baby asleep on me.

I hope you find this enlightening. It's all AI between the robots, besides my formatting.

🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖

The Enduring Value of PayPal: A Comprehensive Investment Case

Navigating the Digital Tides: Why PayPal Remains a Compelling Investment

In the rapidly evolving landscape of digital payments, PayPal stands as a titan, a testament to innovation and adaptability. Far from being a relic of the past, PayPal continues to be a central player, strategically positioned to capitalize on the relentless march towards a cashless, digitally driven economy. This document presents a comprehensive investment case for PayPal, integrating robust financial data and key metrics, an assessment of its management compensation, and a reasoned valuation.

The Tailwind of Digital Transformation: Core Drivers of PayPal's Growth

PayPal's investment appeal is fundamentally rooted in its alignment with powerful, long-term trends shaping the global economy:

* The Mobile Commerce Revolution: The transition to digital and mobile-first commerce is not just a trend, but a fundamental shift. PayPal is at the epicenter, facilitating seamless transactions across online, in-app, social media, and even in-store environments. With mobile payment volume soaring by 55% to $102 billion in 2016 and further accelerated by the global pandemic, PayPal's integrated solutions are perfectly poised for continued expansion.

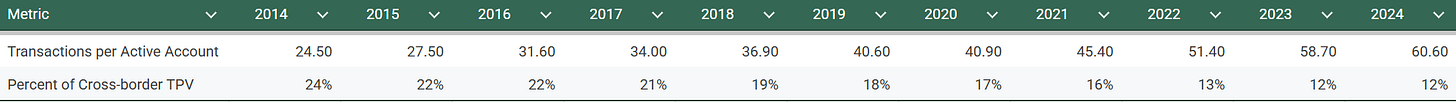

* Unwavering Customer Growth & Engagement: The heartbeat of PayPal's success lies in its ever-expanding and increasingly engaged user base. From 162 million active accounts in 2014 to a remarkable 434 million by 2024, PayPal's reach is undeniable. More impressive still is the doubling of payment transactions per active account, from 24.5 in 2014 to 60.6 in 2024, signaling a profound integration into users' daily financial lives.

* A Rich Tapestry of Innovation: PayPal's product portfolio is a dynamic ecosystem designed to meet diverse financial needs. From the one-touch simplicity of One Touch to the global reach of Xoom for international transfers, the developer-centric power of Braintree, and the ubiquitous peer-to-peer prowess of Venmo (processing $62 billion in TPV by 2018), PayPal continually innovates. Recent advancements like QR code payments, Global Pay Later options (e.g., Pay in 4), and the foray into cryptocurrency demonstrate a forward-looking strategy.

* Strategic Alliances, Expanded Horizons: PayPal understands the power of collaboration. Its strategic partnerships with global payment networks (Visa, Mastercard, Discover), tech giants (Meta, Amazon, Shopify), and financial institutions amplify its growth vectors, democratizing access to the digital economy for millions worldwide.

* The Power of the Two-Sided Network: PayPal's platform inherently connects millions of consumers and merchants, generating invaluable data insights. This rich data not only enhances the user experience but also fortifies its robust security and fraud prevention systems, employing advanced tokenization to safeguard sensitive information.

* Commitment to Financial Inclusion & ESG: Beyond profit, PayPal is dedicated to democratizing financial services, providing accessible products, and extending capital to small businesses and underserved communities. This mission-driven approach is further underscored by ambitious ESG goals, including achieving net-zero greenhouse gas emissions by 2040 and 100% renewable energy use in data centers by 2023.

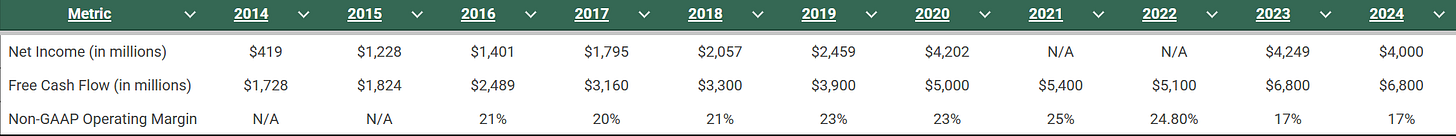

* Exceptional Cash Flow Generation: A hallmark of a resilient business, PayPal consistently generates substantial free cash flow, reaching an impressive $6.8 billion in 2024. This robust cash generation provides the financial muscle for reinvestment, strategic acquisitions, and returning value to shareholders.

Navigating the Headwinds: Risks on the Horizon

While the investment case for PayPal is strong, it is not without its challenges. Prudent investors must acknowledge the following:

* Intense Competitive Landscape: The digital payments sector is a battleground. PayPal faces fierce competition from established financial institutions, other online and mobile payment providers, and nimble fintech startups. This competition extends to securing vital partnerships.

* Evolving Regulatory Scrutiny: Operating globally, PayPal is subject to a complex and ever-changing regulatory environment concerning AML, CTF, privacy, cybersecurity, and consumer protection. Non-compliance or shifts in legislation (e.g., PSD2, virtual currency regulations) can lead to penalties, increased costs, and operational hurdles. Brexit, for instance, has added layers of complexity in the U.K.

* Funding Mix Dynamics: PayPal incurs higher transaction fees when consumers opt for credit card-funded payments compared to debit cards, bank accounts, or PayPal balances. While strategic partnerships drive volume, they can also paradoxically shift the funding mix towards higher-cost options.

* Inherent Financial Risks: Transaction and loan losses, fraud, and abusive behaviors are persistent challenges. PayPal's exposure to customer protection programs, chargebacks, and the accuracy of its credit risk models for loan products requires constant vigilance.

* The eBay Decoupling: The declining revenue contribution from eBay's marketplace, as eBay transitions to its own managed payments system, represents a structural headwind that PayPal must continue to offset with growth in its non-eBay businesses.

* Operational & External Vulnerabilities: System availability, reliability, and security are paramount. Disruptions or breaches can lead to regulatory penalties and reputational damage. Furthermore, global economic conditions, reliance on third-party processors, and the critical need for accurate management of customer funds pose ongoing risks. Competition for top talent in the tech sector also necessitates significant investment in compensation.

PayPal's Financial Pulse: A Decade of Growth and Evolution

PayPal's financial performance over the past decade paints a picture of substantial growth and strategic adaptation. The following tables highlight key aspects of its journey:

(I exported these sheets from Gemini, which is an option, then used AI assistance to make these tables)

Table 1: Growth Metrics (Absolute Values)

Table 2: Engagement and Operational Metrics

Table 3: Profitability Metrics

* Revenue Resilience: PayPal's net revenues have demonstrated remarkable resilience, more than tripling from $8.025 billion in 2014 to $31.8 billion in 2024, underpinning its expanding business footprint.

* TPV Momentum: Total Payment Volume (TPV) has surged over seven-fold, reaching $1.68 trillion in 2024. This astronomical growth is a clear indicator of the widespread trust and adoption of PayPal's payment platform.

* Engagement Deepens: The near doubling of transactions per active account from 24.5 in 2014 to 60.6 in 2024 showcases increasingly profound user engagement, fostering a vibrant ecosystem.

* Strong Cash Generation: Free Cash Flow has seen consistent and robust growth, climbing from $1.7 billion in 2014 to $6.8 billion in 2024. This substantial cash generation provides a strong foundation for future investments and shareholder returns.

* Profitability Focus: While Non-GAAP Operating Margin has experienced some recent fluctuations (peaking at 25% in 2021 before moderating to 17% in 2023-2024), Net Income has generally followed an upward trajectory. The introduction of "Transaction Margin Dollars" as a key performance indicator for 2024 underscores management's renewed focus on driving profitable growth.

Management Compensation: Aligned Incentives for Long-Term Value?

PayPal's executive compensation philosophy is anchored in a "pay for performance" model, meticulously designed to align the interests of leadership with the creation of long-term stockholder value. This approach is also vital for attracting and retaining top-tier talent in a highly competitive industry.

Key components of executive compensation typically include:

* Base Salary: Fairly compensates for daily responsibilities and reflects role scope.

* Annual Incentive Plan (AIP): Rewards achievement of short-term goals. Transitioning to 100% cash in 2024, the AIP now prioritizes Transaction Margin Dollars and a refined Non-GAAP Operating Income (including stock-based compensation expense) for a more direct link to profitable growth. Individual performance, including ESG considerations, also plays a role.

* Long-Term Incentive Plan (LTI): Comprising the largest portion of executive compensation, LTI heavily relies on equity awards, particularly Performance-Based Restricted Stock Units (PBRSUs) and Restricted Stock Units (RSUs). For 2024, LTI PBRSUs shifted to a relative Total Shareholder Return (rTSR) metric against the S&P 500, directly linking payouts to long-term stock performance relative to the broader market.

* Special New Hire Awards: Strategic awards for new executives to compensate for forfeited equity and incentivize their transition to PayPal, ensuring strong alignment with long-term company performance.

Do They Move the Goalposts?

While the Compensation Committee possesses discretion to adjust performance goals in response to unusual events or changes in regulations, this flexibility is balanced by crucial safeguards:

* Explicit Prohibition on Repricing: PayPal's equity plan strictly prohibits the discounting of stock options or the repricing of underwater options without stockholder approval, a vital protection against value dilution.

* Robust Clawback Policies: Executives are subject to clawback policies, allowing for forfeiture or reimbursement of incentive compensation in cases of material code of conduct violations, significant financial or reputational harm, or financial restatements due to executive misconduct.

* Independent Oversight: The Compensation Committee, composed of independent directors, rigorously sets goals, conducts annual risk assessments, and actively engages with stockholders for feedback.

* Performance-Driven Payouts: The absence of guaranteed bonuses for NEOs and the fact that some 2022-2024 PBRSUs vested at 0% due to unmet targets demonstrate that payouts are indeed tied to actual performance.

* Dilution Management: PayPal actively monitors its equity burn rate and implements measures to manage dilution, indicating a responsible approach to equity compensation.

In essence, while the Compensation Committee maintains flexibility, the presence of strong safeguards, independent oversight, and demonstrably performance-linked payouts suggests that PayPal's management compensation is fairly structured and aligns executive incentives with long-term stockholder value creation.

Valuation of PayPal: A Multiples-Based Perspective

To provide an illustrative valuation for PayPal, we will employ a multiples-based approach, leveraging the most recent financial data for 2024. This method, while simpler than a full DCF, offers a practical snapshot of the company's value in relation to its current financial performance and industry peers.

Justification and Reasoning:

* Consistent Revenue Growth: PayPal's sustained revenue growth, from $8.025 billion in 2014 to $31.8 billion in 2024, is a fundamental driver of its intrinsic value, signaling ongoing business expansion.

* Robust Free Cash Flow (FCF): The consistent and strong generation of free cash flow, reaching $6.8 billion in 2024, underscores PayPal's financial health and its capacity to fund future growth, strategic initiatives, and shareholder returns.

* Engaged User Base: The continuous growth in active accounts and increasing transactions per user represent a robust foundation for future revenue streams and network effects.

* Profitability Focus: While the Non-GAAP Operating Margin has seen some recent fluctuations, the emphasis on "Transaction Margin Dollars" for 2024 indicates a strategic pivot towards enhancing profitable growth.

Valuation Calculation (Illustrative):

Using the 2024 financial data:

* Net Revenues (2024): $31.8 billion

* Net Income (2024): $4.000 billion

* Free Cash Flow (2024): $6.8 billion

1. Price-to-Earnings (P/E) Multiple Approach:

The P/E ratio is a widely used valuation metric. For an established, growing financial technology company like PayPal, a P/E multiple in the range of 20x-25x is often considered appropriate for a company demonstrating sustained, albeit moderating, growth.

Let's apply an illustrative P/E multiple of 22x to PayPal's 2024 Net Income:

* Estimated Market Capitalization = Net Income (2024) × Illustrative P/E Multiple

* Estimated Market Capitalization = $4.000 billion × 22

* Estimated Market Capitalization = $88 billion

2. Enterprise Value to Revenue (EV/Revenue) Multiple Approach:

The EV/Revenue multiple is particularly useful for growth companies, as it considers both equity and debt and is less impacted by short-term accounting variations. For a company of PayPal's scale and historical growth trajectory, an EV/Revenue multiple between 2.0x-4.0x is a plausible range within the fintech sector.

Let's use an illustrative EV/Revenue multiple of 2.5x for PayPal's 2024 Net Revenues:

* Estimated Enterprise Value = Net Revenues (2024) × Illustrative EV/Revenue Multiple

* Estimated Enterprise Value = $31.8 billion × 2.5

* Estimated Enterprise Value = $79.5 billion

(Note: To derive a precise market capitalization from Enterprise Value, one would typically subtract net debt. For this illustrative purpose, the EV serves as a direct reference point for total company value.)

Valuation Conclusion and Investment Recommendation:

Based on these illustrative multiple-based valuations, we arrive at a potential market capitalization range for PayPal between approximately $79.5 billion and $88 billion.

This valuation range suggests that PayPal, as of mid-2025, is likely trading at a level that reflects its strong market position, extensive user base, and robust cash generation capabilities. However, it also incorporates the acknowledged challenges related to intense competition and the evolving regulatory landscape, as well as recent shifts in operating margin.

Investment Recommendation: "Hold" or "Cautious Buy" for Long-Term Investors

For long-term investors, PayPal presents a compelling "Hold" or "Cautious Buy" opportunity. The company's enduring strengths, including its vast network, brand trust, continuous innovation, and powerful free cash flow generation, provide a solid foundation. While the recent moderation in Non-GAAP operating margin and temporary dip in active accounts (recovering in 2024) warrant close monitoring, PayPal's strategic pivots and focus on profitable growth could unlock further value.

A more aggressive "Buy" recommendation would likely hinge on clearer, sustained signs of:

* Renewed acceleration in active account growth.

* Consistent expansion of profitability margins.

* Successful diversification and growth of non-eBay revenue streams.

Investors who believe in PayPal's ability to successfully navigate its competitive and regulatory environment, continue innovating its product suite, and improve its core profitability metrics will find a fundamentally strong company with significant underlying value.

🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖

Not too shabby if you ask me for 15 minutes of work.

Again, I hope this was enlightening. And maybe motivating to start exploring AI tools to enhance your own work.

I think of these tools as really capable interns. They can scurry around and find great information. Yet we can’t fully trust them because they are interns and will take things very literally then make mistakes.

So, we still need to stat proof, check sources, and make sure everything is on track.

That’s all for now!

I apologize for such infrequent posts.

👋👋

Let it Compound.

Disclaimer Time!

As always this is not investment advice. Again, nothing here is investment advice.

This information is for educational and entertainment purposes only.

Please, PLEASE, always do your own due diligence. And if need be, consult with an investment professional regarding your finances.

I went back and pulled the questions I asked NotebookLM the best I could. One negative of Notebook LM is it doesn't keep the chat history which is understandable.

I purposely was kinda vague in seeing what it would come up with. Also allowed for some overlapping questions. If I was ultra specific I felt it would defeat the purpose is testing the AIs capabilities.

My questions:

In your opinion, what are major trends impacting PayPal - both positive and negative. And how have these trends affected the company's growth, operations, and financial performance.

How has PayPal stayed ahead of the competition?

How has the company performed in relation to its competitors?

PayPal's biggest threats?

What are key financial trends for PayPal? In your opinion what are key performance metrics for PayPal, highlighting growth, margins, and other KPIs over the past decade, And can you present your findings showcasing key financial and performance metrics from 2014 to 2024 as tables.

Any trends in PayPal's financial position?

How is management compensated?

Do executives move their goal posts at the expense of the company for self enrichment?

Is management compensated fairly?

What are the key valuation and performance metrics?

Then Gemini took the answers to these questions and crafted the investment case.

So this was all written by AI 😢